Quick Stats

Kenya

56.4 Million (2024)

$124 Billion (2024)

2010

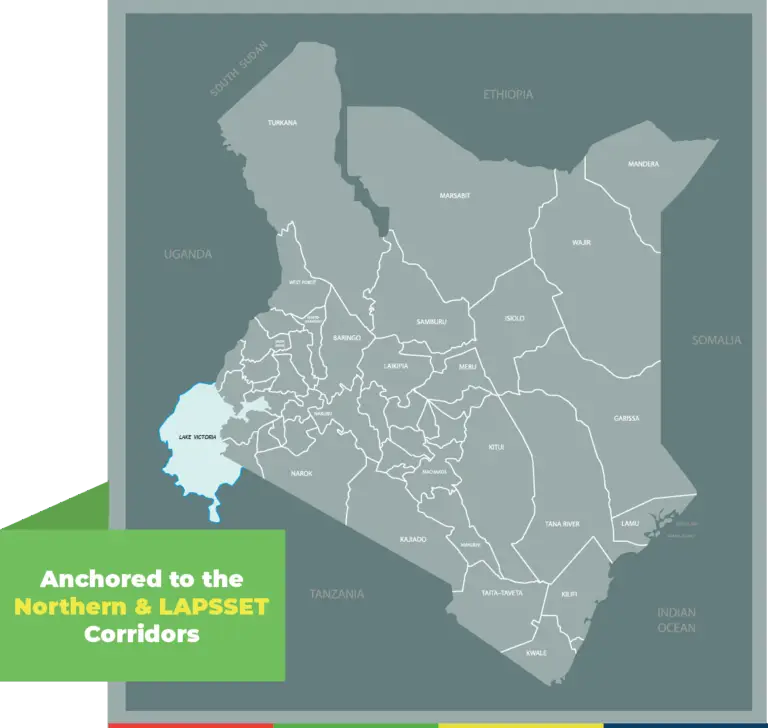

Northern & LAPSSET

Tea (16%), Cut Flowers (9.5%), and Gold (3.8%).

- Population and GDP size- World Bank Data – https://data.worldbank.org/indicator

- Trade- OEC- https://oec.world/en/profile/country/

Kenya is a critical gateway into East Africa and a regional hub for trade, finance, logistics, and digital services. Its strategic location on the Indian Ocean positions the Port of Mombasa as a main entry point for goods destined for countries along the Northern Trade and Transport Corridor, linking over 200 million people across Uganda, Rwanda, Burundi, northern Tanzania, South Sudan, and eastern DRC.

582,646 sq kms

56.4 Million people

With the high volume of trade that flows through Mombasa, the port plays a vital role in driving regional economic integration and advancing Kenya’s ambition to become the pre-eminent trade and transit hub for East Africa. The ambition to transition Kenya into an industrialising, middle-income economy driven by exports, manufacturing, and innovation is captured in Vision 2030, Kenya’s long-term development strategy.

Kenya has prioritised the African Continental Free Trade Area (AfCFTA) implementation, deepened investments in (geothermal, solar, and wind power) , and promoted new sectors such as the blue and circular economies. Kenya’s horticultural and agricultural value chains continue to anchor its export base. In 2023, the agricultural sector contributed approximately $25.5 billion – 22% of GDP- and employed over 40% of the population, with horticulture, tea, and coffee the main earners. A drive to digitise public services is positioning it as a continental tech leader. Devolution has added another layer of opportunity. With 47 counties empowered to lead investment promotion and local economic development, fostering more decentralised and resilient growth. TMA’s Kenya Country Programme taps into these dynamics to strengthen the country’s infrastructure, institutions and innovation.

Early Milestones

Since 2010

Since 2010, TMA has worked alongside the Government of Kenya and its partners to reduce the time, cost, and complexity of trade. Efforts centred on improving the performance of the Port of Mombasa and the Northern Corridor, which is a vital artery for East African trade.

Upgrades to major gates and access roads at Mombasa Port, including Port Reitz, Kipevu, Mbaraki and Magongo, have eased freight evacuation and reduced congestion. One Stop Border Posts at Moyale, Malaba, Busia and Taveta now allow goods to cross with far fewer delays, reducing time by more than half at some borders. Meanwhile, new systems such as the Kenya Revenue Authority Integrated Customs Management System have reduced cargo clearance time from two days to as little as three hours, and regional cargo tracking system have improved security along the Northern Corridor and contributed to reducing the time taken for cargo to move from Mombasa Port to Uganda and beyond. This has boosted efficiency in logistics, distribution and freight-forwarding, sectors that thrive when trade flows more predictably.

Beyond infrastructure, TMA supported efforts to strengthen standards, expand SME access to global markets, and ensure the benefits of trade extend to those previously excluded. Laboratory upgrades at Kenya Bureau of Standards have made compliance more accessible and affordable, while thousands of small-scale traders, many of them women and youth, are now better able to navigate cross-border systems and connect to new markets.

TMA Strategy 3

2023 - 2030

The new strategy responds to Kenya’s evolving trade landscape by integrating public sector reform with private sector competitiveness, while placing renewed emphasis on catalytic investment, sustainability, and digital innovation. Through this approach, TMA aims to further reduce the time and cost of trade, support SMEs through training and market access, and promote environmentally friendly logistics, which will lower pollutants and enhance the global competitiveness of Kenyan exports.

Interventions will be structured around the following six portfolios:

Trade Environment and Policy Reform

To strengthen Kenya's trade and investment climate, we will support the domestication and implementation of international agreements, including AfCFTA and bilateral frameworks. Efforts will include removing non-tariff barriers (NTBs), scaling digital platforms like the EAC Buyer-Seller Platform, and enhancing uptake of authorised economic operator schemes. A strong emphasis will be placed on engaging the private sector to improve policy outcomes.

Quality and Value of Kenya's Exports

To improve the quality and value of Kenya's exports, TMA will continue to support the harmonisation of standards and promote mutual recognition agreements. Efforts will also include capacity building for Kenya's bureau of standards, support for industry self-regulation, and enhanced awareness of new legislation such as the Food Safety Coordination Bill. Agro-SMEs will benefit from cold storage infrastructure and tailored support for sustainable innovation and alternative finance.

Digitalisation

In digitalisation, TMA will scale initiatives such as smart border solutions, integrated port and corridor systems, and intelligent customs tools, while expanding the Trade Logistics Pipeline and investing in traceability systems, particularly for food and textiles, to meet global market requirements.

Infrastructure Development

TMA Kenya will support upgrades to ports, industrial parks, and trade corridors, including the Naivasha ICD masterplan and cool logistics hubs. Feasibility work on the Lamu-Addis corridor and eco-industrial park investments will be advanced. On the finance front, TMA will promote sustainable finance instruments and expand access to trade and asset finance for SMEs.

Climate Resilience and Sustainability

Climate resilience and sustainability is both a cross-cutting theme and a standalone focus with TMA supporting development of climate-smart trade policies, smart logistics, and promote multimodal transport options. Support to climate risk assessments across value chains and investments in eco-friendly infrastructure at key trade nodes will be considered.

Resilient

Portfolio

The resilience portfolio will support marginalised groups and climate-affected communities—through resilient trade interventions. Kenya will scale platforms like iSOKO, support cooperative models, and promote food system resilience through compliance with standards, aggregation systems, and improved access to finance. The aim is to ensure trade contributes directly to food security and poverty reduction.

Digital Trade Systems

Green Trade

Resilient and Inclusive Trade

Value and Quality of Traded Goods

Physical Infrastructure

Physical Infrastructure

Trade and Investment Environment

- Trade Environment and Policy Reform: will strengthen Kenya’s trade and investment climate by supporting the domestication and implementation of international agreements, including AfCFTA and bilateral frameworks. Efforts will include removing non-tariff barriers (NTBs), scaling digital platforms such as the EAC Buyer-Seller Platform, and enhancing uptake of authorised economic operator schemes. A strong emphasis will be placed on engaging the private sector to improve policy outcomes.

- To improve the quality and value of Kenya’s exports, TMA will continue to support the harmonisation of standards and promote mutual recognition agreements. Efforts will also include capacity building for Kenya’s Competent Authorities, support for industry self-regulation, and enhanced awareness of new legislation such as the Food Safety Coordination Bill. Agro-SMEs will benefit from cold storage infrastructure and tailored support for sustainable innovation and alternative finance.

- In digitalisation, TMA will scale initiatives such as smart border solutions, integrated port and corridor systems, and intelligent customs tools, while expanding the Trade Logistics Pipeline pilot and investing in traceability systems – particularly for food and textiles – to meet global market requirements.

- Infrastructure development remains a core component. TMA Kenya will support upgrades to ports, industrial parks, and trade corridors, including the Naivasha ICD masterplan and cool logistics hubs. Feasibility work on the Lamu-Addis corridor and eco-industrial park investments will be advanced. On the finance front, TMA will promote sustainable finance instruments and expand access to trade and asset finance for SMEs.

- Climate resilience and sustainability is both a cross-cutting theme and a standalone focus. TMA will support both the development of climate-smart trade policies and emissions reduction in logistics and promote multimodal transport options. Support for climate-risk assessments across value chains and investments in eco-friendly infrastructure at key trade nodes will be considered.

- The resilience and inclusion portfolio will support marginalised groups and climate-affected communities through resilient trade interventions. Kenya will scale platforms like iSOKO, encourage cooperative models, and promote food system resilience through compliance with standards, aggregation systems, and improved access to finance. The aim is to ensure trade contributes directly to food security and poverty reduction.

- Travel times fell by 54% between 2019 to 2023, saving an estimated 182 hours per vehicle annually (Independent Evaluation Reports, 2024)

- Truck turnaround time at Mombasa Port reduced by 43%, from 26 hours to 15 between 2019 and 2023. (Endline Survey Report for Mombasa West Roads Improvement Programme November 2023)

- The time taken to transport goods from the port to Container Freight Stations (CFS) in Mombasa reduced from 164 minutes in 2019 to 134 in 2023.

- Interventions at Mombasa Port have contributed to a reduction in cargo dwell time from 7.2 days in 2012 to 3.3 in 2021 (Source: Northern Corridor Transport Observatory, April 2022

- KRA’s Integrated Customs Management System contributed to a 94% reduction in clearance time for air freight, from an average of 2 days in 2018 to 2-3 hours in 2023.

- The return on trade was $837 ($570 from customs duties and $267 from taxes collected from other international trade transactions) for each $1 of an approximately $33 million invested by TMA across Strategy 1 and Strategy 2.

- Horticulture Market Assistance Programme (HMAP) interventions in Kenya contributed to an estimated total trade value of approximately $51 million.

- For the Integrated Agricultural Trade Management System, the average time taken for the Agriculture and Food Authority (AFA) in Kenya to issue certificates reduced by 78% from 9 days in 2016 to 2 in 2021.

- Kenya Plant Health Inspectorate Services (KEPHIS): the average time for traders to acquire a seed certificate reduced from 25 days to 3 in 2021.

COUNTRY DIRECTOR

Lillian is a market systems and SME development specialist with over 15 years of experience in international development. As TMA’s Kenya Country Director since January 2025, she leads TMA flagship programme in greening trade – the EU funded Business Environment and Export Enhancement Programme which targets to shift at least 50% of Kenya’s horticultural exports from air to sea, with the twin goals of reducing costs and supporting Kenya to deliver greener products to in the global market. She is also spearheading partnerships with government institutions, including the Kenya Revenue Authority and Kenya Ports Authority to streamline export processes and reduce border delays.

Prior to joining TMA, Lillian served as Country Director for Swisscontact and previously worked with KPMG’s International Development Advisory Services, where she focused on audit, compliance, and SME development across various donor-funded programmes. She holds a master’s of business administration (MBA) in International Business and bachelor’s in actuarial science from the University of Nairobi.