Quick Stats

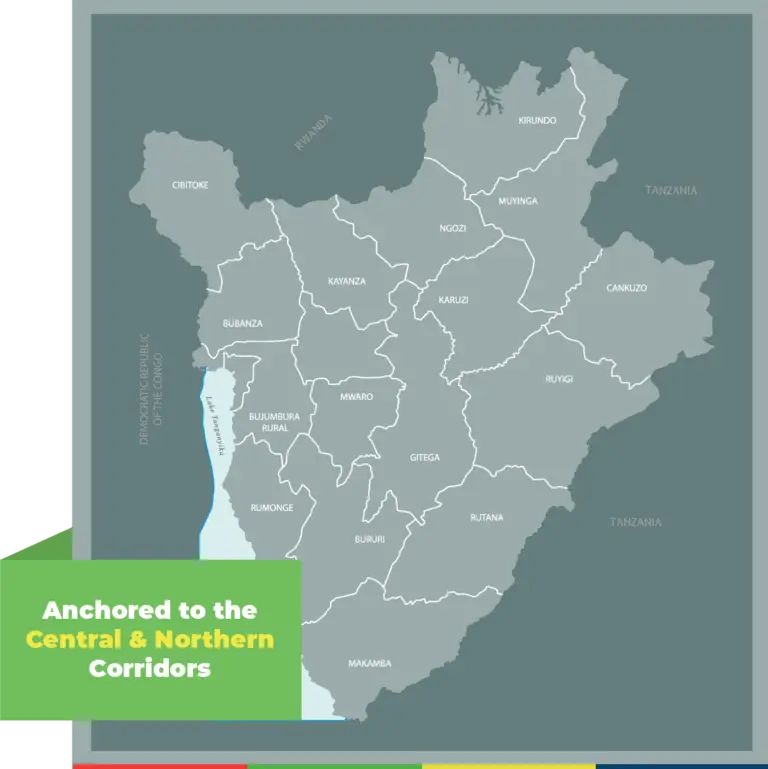

Burundi

13.4 Million (2024)

$2.15 Billion (2024)

2011

Northern & Central

Gold (66%), Coffee (22%), Tea (6%)

- Population and GDP size- World Bank Data – https://data.worldbank.org/indicator

- Trade- OEC- https://oec.world/en/profile/country/

Burundi, a landlocked country of just under 28,000 square kilometres in the Great Lakes region, remains predominantly agrarian, with subsistence agriculture employing the majority of its population and contributing significantly to the national economy. Structural transformation has been limited, and the country remains vulnerable to climate variability and commodity price shocks.

27,830 sq

kms

13.4 Million people

Following a period of political instability and donor disengagement between 2015 and 2020, Burundi has gradually re-established its presence in regional and global forums. The lifting of sanctions by the European Union in 2021- followed by similar actions from the United Kingdom and the United States, marked a critical shift in diplomatic relations.

These developments have reopened avenues for development cooperation, trade, and investment, and signalled renewed confidence among international partners. Trade is a central pillar of Burundi’s economic recovery and integration agenda. Strategically positioned along the Central Corridor, over 80% of Burundi’s international trade flows through the Port of Dar es Salaam in Tanzania. However, emerging opportunities along the Northern, Southern, and nascent Western corridors are expanding the country’s connectivity prospects. Additionally, Lake Tanganyika presents untapped potential for regional trade. Targeted investments in port infrastructure and logistics around the lake could strengthen cross-border trade and further integrate Burundi into regional markets.

Early Milestones

Since 2011

Since 2011, TMA has worked alongside public institutions, private sector actors, and development partners to modernise trade systems, upgrade cross-border infrastructure, advance sustainable economic participation, and support reforms in trade policy and governance.

An early milestone was support for the reform of the Burundi Revenue Authority (OBR), merging customs and tax services into a single, more efficient institution. This contributed to a boost in domestic revenue, which almost doubled between 2013 and 2015, giving the government fiscal space to invest in national priorities .

In 2015, programming placed greater attention on supporting the private sector and women traders and those who are often excluded from trade. At the same time, it deepened collaboration with critical trade agencies, such as Customs, and the Bureau of Standards, so as to uphold mechanisms that increased and supported private sector integration in regional trade. A partnership with the United Nations Trade and Development (UNCTAD), led to the digitalisation of the OBR’s systems, including the roll out of the ASYCUDA platform (a computerised customs management system), and the Electronic Single Window (eSW), an automated system for processing exports and imports.

TMA Strategy 3

2023 - 2030

TMA is building on more than a decade of work in Burundi with a more integrated, future-facing approach, anchored around four core pillars:

Promoting greener, more resilient trade

Advancing digital systems

Improving the trade and investment environment

Enhancing the quality and value of traded goods

As Burundi deepens its engagement with the African Continental Free Trade Area (AfCFTA), TMA is working with government institutions to adopt AfCFTA instruments and align national frameworks. This includes building the capacity of legislators to understand and leverage AfCFTA opportunities, a contribution that supported the successful ratification of the protocol.

In parallel, interventions have been rolled out to prepare the private sector to expand exports and compete in a more integrated regional market. Focus areas include high-potential value chains, such as coffee, tea and horticulture, where TMA is complementing other donor initiatives to ensure coordinated support and avoid duplication. To improve the competitiveness of Burundian products, TMA is supporting the national standards body, the Bureau Burundais de Normalisation et Contrôle de la Qualité or BBN, by training technical staff in certification processes, as a step towards the BBN’s full accreditation, aiming to align it with global standards and improve market access.

Building on earlier digital gains, efforts now extend to automating export and quality control systems, supporting e-commerce and strengthening the infrastructure needed for a modern, connected trade ecosystem.

Results

- Annual revenue doubled, from $240 million in 2009 to $480 million in 2015. Current revenues collected by OBR is $667 million (2024)

- Higher collections enabled the government to self-finance flagship projects, including Karuzi Provincial Hospital and the Kajeke hydro-electric dam.

(Source: OBR Annual Activity Report Budgetary year 2023-2024)

(Source: Central Corridor Report, 2024)

- Ministry of Health cut approval times for medicines from 5 days to under one by end of 2024.

COUNTRY REPRESENTATIVE, BURUNDI

Christian is an accomplished development leader with over 15 years experience advancing regional integration, trade facilitation, and economic empowerment in Burundi and across East Africa. As TMA’s Burundi Country Representative since 2019, he has delivered trade initiatives including customs digitisation at OBR, supporting the private sector to participate at the regional EAC level, and advising on governance structures for TMA’s expansion into West Africa. Most recently he secured €1.95 million Ugushora export programme, to enhance Burundi’s market access. He previously advised six African countries at Christian Aid and held roles at the U.S. Embassy and Burundi Business Incubator. Christian holds a master’s in business administration from USIU, executive education certificate from Harvard Kennedy School, and a bachelors from Uganda Martyrs University, and serves on boards of regional organisations supporting finance, SMEs, and inclusive development.