Quick Stats

Zambia

21 Million (2024)

$26 Billion (2024)

Year

2020

Dar es Salaam & North-South

Raw Copper (44%), Refined Copper (18%), Gold (12%)

- Population and GDP size- World Bank Data – https://data.worldbank.org/indicator

- Trade- OEC- https://oec.world/en/profile/country/

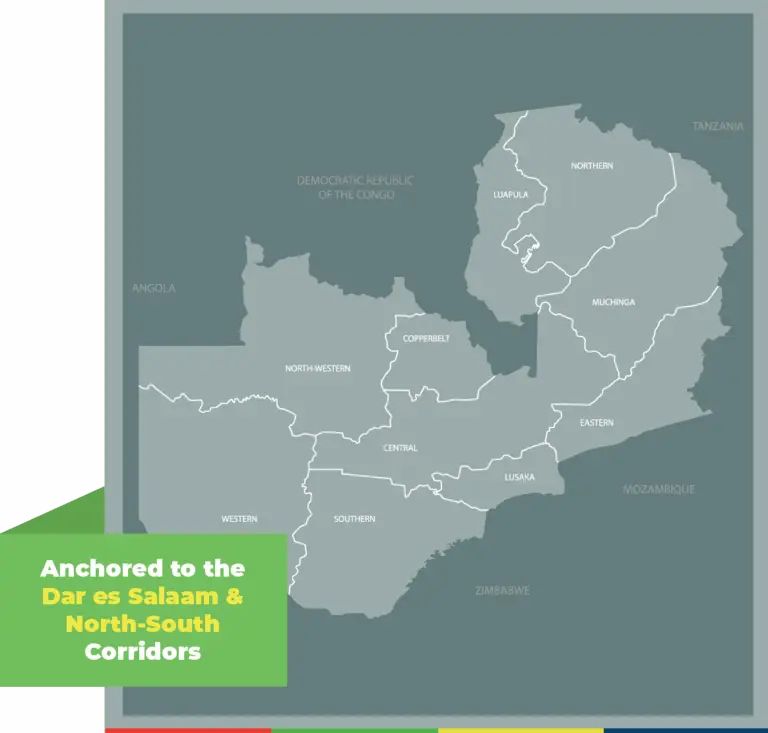

Zambia is a landlocked country in Southern Africa with its economic activity concentrated around Lusaka, the capital and the Copperbelt, both of which serve as the country’s main commercial hubs. It shares borders with eight countries – the Democratic Republic of Congo, Tanzania, Malawi, Mozambique, Zimbabwe, Botswana, Namibia and Angola – making it both a land-linked nation and a natural bridge between Southern and East Africa, offering potential to serve as a regional trade and transit hub.

752,618 sq

kms

21 Million people

However, its landlocked status also creates trade inefficiencies, with high costs and delays along regional routes in multiple countries, making improved connectivity and border efficiency key to unlocking its trade potential. Mining contributes approximately 12% of Zambia’s GDP and accounts for around 75% of its export earnings, yet it employs only 2.1% of the population. By contrast, agriculture provides livelihoods for more than half the population, yet contributes less than 5% to GDP.

Anchored to the Dar es Salaam & North South Corridor

This gap between economic output and employment signals a need for a more inclusive economic growth model that integrates high employment sectors, such as agriculture, into trade and industrial development strategies, through strengthening trade connectivity, boosting competitiveness, and harnessing the potential of trade corridors. Regional integration is a priority for Zambia as it is a member of two major regional trade blocs – the Common Market for Eastern and Southern Africa (COMESA) and the Southern African Development Community (SADC). While this dual membership reflects Zambia’s commitment to regional integration, it also introduces complexity. Businesses often struggle to navigate overlapping trade regimes, differing rules of origin, and regulatory standards, which can limit the private sector’s ability to fully benefit from regional market opportunities. TMA supports the Government’s efforts to overcome these barriers, with a focus on trade facilitation, better infrastructure, and reduced regulatory inefficiencies, positioning the country to take full advantage of its strategic location and regional trade ambitions.

Early Milestones

Since 2020

In 2020, Zambia faced an urgent challenge of maintaining the movement of essential goods through its borders amidst a global pandemic. The Government of Zambia in partnership with TMA responded swiftly, supporting emergency trade protocols while laying the foundation for deeper, long-term reforms in cross-border trade infrastructure and policy. This marked TMA’s entry into Zambia.

The initial response focused on operational continuity. More than 140,000 protective items, including PPE, thermometers and sanitation equipment, were distributed to frontline border staff. Public awareness campaigns were rolled out on radio and billboards, and signage to improve social distancing and traffic flow was installed at high-traffic border points, from Nakonde to Kapiri Mposhi, Mpika, Kasama, Mbala Junction, Mpulungu Harbour and Zombe. These efforts not only kept trade flowing but also safeguarded frontline workers during a period of uncertainty.

The crisis response evolved into a broader agenda to modernise Zambia’s role in regional trade. Nakonde, a major entry between Zambia and Tanzania, was prioritised for a full one stop border post (OSBP) upgrade. Planning for the infrastructure reform was done collaboratively by TMA, Trade Catalyst Africa and Tony Blair Institute in alignment with Zambia’s ambitions to strengthen regional integration. Now, phase one of a major infrastructure project, funded by UK is underway and set for completion in 2025.

But upgrading OSBP infrastructure is only one part of the job. The operationalisation of the Mchinji–Mwami OSBP, Zambia’s first bilateral OSBP with Malawi has demonstrated that institutional capacity, harmonised procedures and frontline coordination are just as critical. Here, TMA worked closely with the Ministries of Trade and Industry in both countries to co-develop joint procedures, training protocols, and public information campaigns. These efforts led to more predictable clearance processes, greater inter-agency coordination and improved experiences for traders – especially small scale women cross-border traders. The Mchinji-Mwami OSBP was officially launched in December 2022.

TMA Strategy 3

2023 - 2030

As Zambia positions itself as a key player in regional supply chains, the next phase of TMA’s support is focused on embedding systems-level reform. The emphasis is on transforming trade from a transactional process into a lever for national development-anchored in institutional efficiency, infrastructure connectivity, and inclusive growth. Between now and 2030, the programme will continue working in lockstep with the Zambian Government and regional bodies to strengthen cross-border trade infrastructure and reduce procedural bottlenecks. Strategic priorities include:

Physical

Infrastructure

Improving the trade and investment environment

Resilient and Inclusive

Trade

- Support corridor development and border management, by establishing joint border committees at Nakonde, Chirundu, Kazungula, Kasumbalesa, and Mwami.

- Digitising customs and sanitary and phyto-sanitary systems (e.g., ASYCUDA, Single Window); cross-border data exchange (with Tanzania, Mozambique, Zimbabwe, South Africa); and installation of smart gates, RFID tracking, and cargo tracking integration.

- Enhanced trade environment by capacity building for government and the private sector; strengthening implementation of AfCFTA, the WTO Trade Facilitation Agreement, and regional protocols; enhancing the Authorised Economic Operator (AEO) programme; and introducing real-time non-tariff barrier (NTB) reporting tools.

- Support standards and SPS compliance, by strengthening electronic phytosanitary certification (ePhyto); harmonising standards and risk management protocols; and upgrading border laboratory capacities and training.

i) New access roads, buildings, ICT systems, and a drive through cargo scanner. Phase 1 is at 90% completion as of July 2025.

Targeted Results:

1. Border cargo clearance time reduced from over 60 hours to under 10 by 2030.

2. A 15% average reduction in costs to move goods and services across the border.

COUNTRY DIRECTOR, ZAMBIA

Jovin Mwemezi is the Country Representative of TradeMark Africa in Zambia since ……….

- Jovin.mwemezi@trademarkafrica.com