Quick Stats

Tanzania

69 Million (2024)

$79 Billion (2024)

Year

2011

Central & Dar-es Salaam

Gold (45%), Refined Petroleum (3.4%) & Dried legumes (3.0%)

Data Source:

- Population and GDP size- World Bank Data – https://data.worldbank.org/indicator

- Trade- OEC- https://oec.world/en/profile/country/

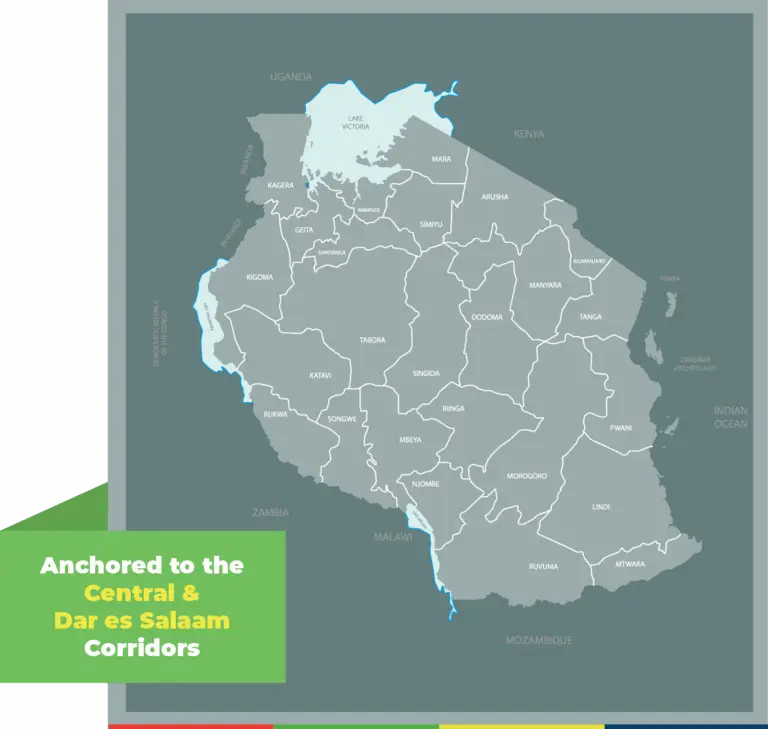

Tanzania’s geography positions it as a natural trade hub for East, Central, and Southern Africa. Encircled by eight countries – Kenya, Uganda, Rwanda, Burundi, Democratic Republic of Congo (DRC), Zambia, Mozambique, and Malawi – and with a 1,400 kilometre stretch of Indian Ocean coastline, Tanzania offers trade routes through the Port of Dar es Salaam, which remains one of the busiest in the region.

947,300 sq

kms

69 Million people

Secondary ports in Tanga and Mtwara, which connect to the Tanga and Mtwara corridors respectively, offer emerging routes. Tanga Corridor connects northwards to Uganda, Burundi, Rwanda and Kenya, while Mtwara reaches Southern Tanzania, towards Mozambique and Malawi. Moreover, the Southern Agricultural Growth Corridor of Tanzania (SAGCOT), which is rich in agricultural resources, promises a logistical lifeline for the wider region.

Anchored to the Central & Dar es Salaam via Tanzania

Agriculture contributes approximately 26% of GDP; however, export performance in subsectors such as grains, horticulture, livestock, and fisheries, continues to be hampered by infrastructure deficits, limited value addition, and challenges in meeting international standards. In newer sectors such as seaweed, particularly in Zanzibar, production remains largely informal and underfinanced.

The Government has taken steps to modernise the trade environment with major infrastructure improvement underway and the launch of the revised National Trade Policy (NTP) in July 2024. The NTP prioritises regulatory reform, institutional coherence, and digitalisation of trade processes to improve competitiveness.

Signs of progress are emerging as Tanzania’s exports to regional partners continue to rise. Between 2016 and 2023, exports to the East African Community (EAC) almost tripled, from TZS 1.12 trillion, (approx. $418million). Over the same period, exports to the Southern African Development Community (SADC) doubled in trillions.

Early Milestones

Since 2011

For more than a decade, TMA has partnered with the Government of Tanzania and the private sector to turn trade facilitation into measurable results. Backed by roughly $120 million in donor funding, the partnership resolved chokepoints at Dar es Salaam port with construction of deeper berths, upgraded roads, and wider gates for faster cargo evacuation, while construction and operationalisation of four one-stop border posts – Tunduma, Kabanga, Mutukula and Holili – including installation of cargo scanners, now ensures cargo moves through faster.

Domestic quality and sanitary and phytosanitary (SPS) regimes in Zanzibar and on the mainland, particularly through collaboration with the livestock and fisheries, agriculture, and industry and trade ministries, have been lifted to international standards, giving Tanzanian horticulture and seafood a passport to premium markets. Red tape has been pared away as TMA’s facilitation underpinned the current National Trade Policy which provided frameworks for streamlined customs, standards and licensing procedures. Thousands of SMEs have been coached, certified and connected to buyers, adding fresh products to the country’s export mix.

TMA Strategy 3

2013 - 2030

TMA’s next seven-year strategy in Tanzania aims to cushion the nation against higher logistics costs, environmental shocks and shifting geo-politics, by facilitating programmes around the following portfolios:

Resilient and Inclusive Trade

Digital Trade Systems

Trade and Investment Environment

Value and Quality of Traded Goods

Enhance trade and investment environment by supporting the review and development of trade-related policies and strategies identified in the National Trade Policy. These will include: polices on trade, local content, and investment; strategies on e-commerce and exports; implementation of regional and global trade agreements; and removal of non-tariff barriers.

Facilitate digitalisation of trade systems by completing customs automation; digitisation of permits and licences (including for standards agencies), development of a single window for investors, upgrades to certificates of origin systems, and enhanced corridor monitoring tools for the Dar and Central corridors.

Improve the quality and value of traded goods through partnerships with bureau of standards to strengthen SPS and standards laboratories, set up sector centres of excellence; and certify more firms so that Tanzanian produce meets high-value market requirements.

Build more resilient trade by expanding digital financial access and market tools for women and youth; fund civil society advocacy so their interests shape border and tax policy.

Facilitate improvement of physical connectivity through installation of smart border technologies and new scanner at major border crossing points to cut inspection queues, tighten security and reduce carbon heavy idling

Results:

1. Contributed to increased annual cargo volume from approx. 14 million metric tonnes in 2017 to 21 in 2022/233.

2. Average dwell time for transit containers fell from 12 days in 2017 to 9.5 in 2021.

Highlighted Results:

1. Truck clearance time at Tunduma reduced from 5 days to 1 thus better asset utilisation for transporters.

Results:

1. 100% reduction in claim processing time as a result of digitisation of the Warehouse Receipt System (WRS) Form 7 in Tanzania.

2. Livestock and fish permits issued in one hour in 2024, down from wait time of 14 days in 2022, resulting in quicker export cycles, broader export base, and doubling of government revenue once MIMS went live.

3. Farmers trading through TMX doubled their earnings compared to their counterparts using informal channels, resulting in better rural livelihood outcomes.

Results:

1. $18 million in additional exports recorded by targeted firms between 2021 and 2023.

COUNTRY DIRECTOR

Elibariki is a seasoned trade professional with over a decade of experience in the development sector. In his current capacity, he champions for the participation of Women in Trade in Tanzania, having fundraised over $1 million for women programmes in the last two years, conceptualise and lead infrastructure projects at the Port of Dar es Salaam and inland borders, and build partnerships with international development partners and Tanzania’s trade agencies to enhance the country’s business competitiveness.

Prior to his current role, he served as Chief of Party at TetraTech a US based company for the USAID Feed the Future Tanzania Private Sector Strengthening Activity, and was previously the National Coordinator for the Non-Tariff Barriers Elimination Programme at the Tanzania Chamber of Commerce, Industry and Agriculture (TCCIA), as well as Trade Officer at the Ministry of Industry and Trade. Shammy has served as an Assistant Lecturer in the Department of Management and Economics at the Institute of Finance Management and holds a master’s degree in international trade and a bachelor’s in business administration from the University of Dar es Salaam.