Quick Stats

Rwanda

14.2 Million (2024)

$14.2 Billion (2024)

2010

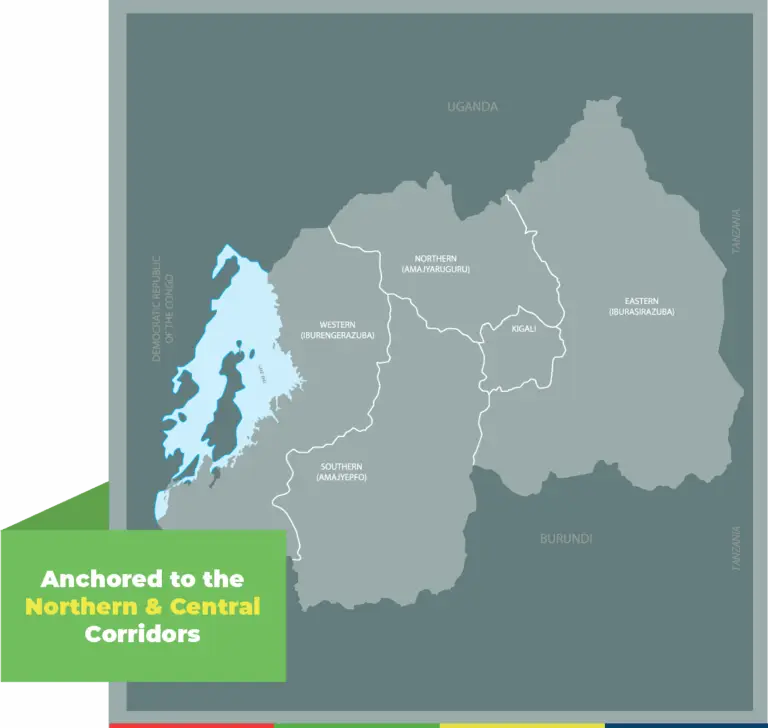

Northern & Central

Gold (66%) Niobium, Tantalum, Vanadium and Zirconium Ore (7.6%) Coffee (6%)

- Population and GDP size- World Bank Data – https://data.worldbank.org/indicator

- Trade- OEC- https://oec.world/en/profile/country/

Rwanda is one of Africa’s fastest-moving economies. In the five years up to 2024, real GDP expanded by roughly 7% a year according to the World Bank, with 9.7% posted in the first half of 2024 buoyed by reviving tourism, new trade infrastructure and a pick-up in light manufacturing.

26,338 sq

kms

14.2 Million people

Governance scores have risen, corruption indices have fallen, and the country now ranks among Africa’s leaders on gender parity, competitiveness and ease of doing business. GDP growth is expected to maintain momentum in 2025-26, as an outward-looking growth strategy underpins performance.

Anchored to the Nothern & Central Corridor

Yet the high cost of moving goods through distant seaports, a low development of value-chains, and limited uptake of international quality standards still holds businesses back. The World Bank’s latest Logistics Performance Index scores Rwanda at 2.8/5, reflecting expensive freight and energy and thin regional links.

In light of this, the Government Vision 2050 and the National Strategy for Transformation have set out plans to diversify exports, cut logistics costs and plug Rwandan producers into regional and global supply chains.

Early Milestones

Since 2010

Since 2010, and with support from development partners, TMA partnered with the government of Rwanda and channelled roughly $100 million into Rwanda’s trade infrastructure – both digital and physical- reducing clearance times and costs and anchoring the country as a competitive trade partner in the Great Lakes gateway. One-stop border posts at Ruzizi and Kagitumba, the new Rubavu lake ports, and digitalisation of key trade processes – including the electronic single-window, cargo tracking system and risk management tools – now move goods with speed and transparency. Backed by solid policy work and support for thousands of MSMEs, through for example the automation of services at the Rwanda Standards Board, training agri-food SME’s and guiding them towards adoption of international food safety standards, unlocked new markets and attracted fresh capital to Rwanda.

TMA Strategy 3

2023 - 2030

Building on that record, TMA’s 2023-30 strategy targets to deliver atleast 40,000 jobs and catalyse an average of $18 million in value of additional exports to deliver the following;

Resilient and Inclusive Trade

Digital Trade Systems

Trade and Investment Environment

Value and Quality of Traded Goods

Physical Connectivity

Digital trade systems

Complete the upgrade and full integration of the Electronic Single Window and related Single Window for Information Trade portals, enhance the Trade Portal with AI enquiry services, streamline border procedures at Rusizi II and other key crossings, embed e-certification and cargo-tracking technology, and build a Trade Logistics Information Pipeline to give end-to-end visibility of exports with destination markets.

Trade and investment environment

Support Rwanda in aligning its trade rules with the AfCFTA, the WTO and regional blocs; strengthen the National Trade Facilitation Committee; streamline reporting of non-tariff barriers; equip the private sector to shape policy; and seize new continental markets.

Physical connectivity

Complete the Lake Kivu port network through installation of navigation aids, modernise selected road links on the Northern and Central Corridors, and de-risk private investment in industrial and agro-logistics hubs such as Bugesera and Rwamagana. All new infrastructure will meet circular-economy and low-carbon standards to help Rwanda hit its 2035 NDC Targets.

Quality and value of goods

Upgrade the national standards and sanitary and phytosanitary system, create centres of excellence, and coach SMEs to meet export-grade requirements, thereby moving more Rwandan firms into higher-value regional and global value chains.

Resilience and inclusive trade

Extend the Women-in-Trade model to formalise and finance at least 15,000 more women, youth and PWD traders; link co-operatives to regional buyers via digital platforms; and support the embedding of gender reforms in customs and taxation policy.

Interventions:

1. Coaching in management, value addition and business financing, organising and hosting international trade shows, support with acquiring standards.

Results:

1. The CLMS slashed the cost of issuing a product certificate by 85% (against a target of 30%); from $39 in 2019 to $6 in 2024, while linking 20 public agencies into a single, transparent data platform that speeds up approvals and cuts red tape.

2. The average time for acquiring a certificate, licence or permit from RURA decreased from 16 hours before automation in 2020, to two in 2022.

Results:

1. Reduction in average time taken to get final approval of the RSB services from about 8 hours in 2022 to 3 in 2024.

COUNTRY DIRECTOR

Rosine is an International Trade development expert, who was instrumental in the successful review of the protocol establishing the Customs Union of the Economic Community of Central African States (ECCAS). As TMA’s Country Director since 2023, she leads the conceptualisation of trade facilitation initiatives ranging from infrastructure development, customs improvements, and digitisation of government services related to trade.

Prior to joining TMA, Rosine served the Rwanda Revenue Authority in different capacities including as Commissioner of Customs Services and most recently as the Commissioner of Internal Audit. She holds a master’s in international Customs Law and Revenue Administration from University of Canberra, Australia, and a bachelor’s in business administration from University of Rwanda. A World Customs Organisation accredited trainer of customs and trade facilitation matters, Rosine has represented Rwanda in major negotiations under AfCFTA, WTO, EAC, COMESA, and ECCAS.