Quick Stats

Ethiopia

134 Million (2024)

$127 Billion (2024)

2018

Djibouti Corridor

Coffee (33%) Dried Legumes (22%) Cut Flowers (6.5%)

- Population and GDP size- World Bank Data – https://data.worldbank.org/indicator

- Trade- OEC- https://oec.world/en/profile/country/

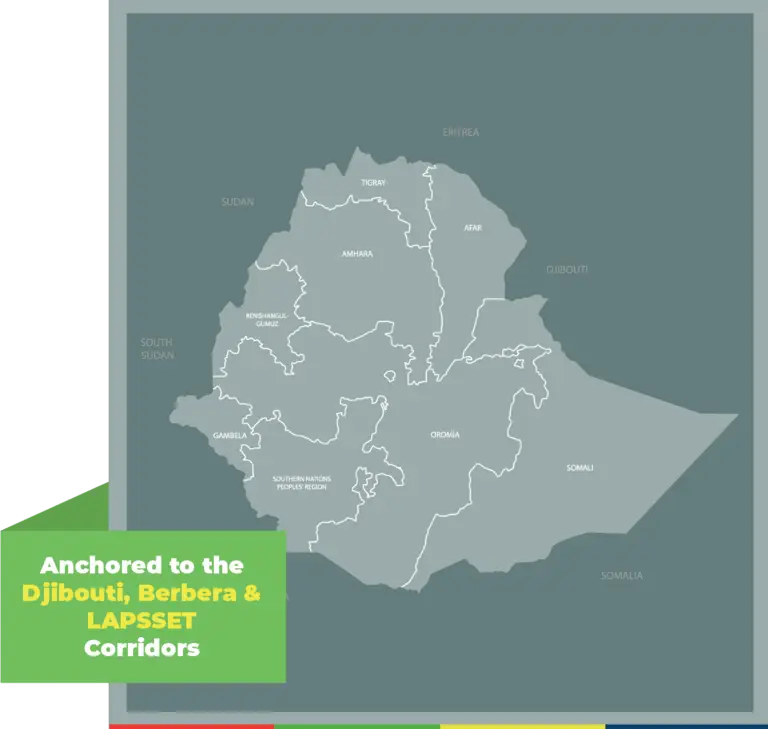

Ethiopia, home to over 123 million people, is one of Africa’s most populous and strategically positioned nations. Though landlocked, its location at the crossroads of East Africa and the Middle East, grants it access to global supply chains through its trade corridors – notably Djibouti, Berbera and the LAPSSET Corridor – making it a strategic investment destination.

1,112,000 sq kms

123 Million people

Over the last decade, Ethiopia has maintained an average annual growth rate of 6%. Yet challenges remain. Per capita gross national income stands at $1,020, macroeconomic instability persists, and export diversification remains limited. To address these factors, the Government is pursuing a long-term shift towards a private sector-led economy, guided by its 10-Year Development Plan and the Home-Grown Economic Reform Agenda.

Anchored to the Djibouti Corridor

Recent reforms include liberalisation of the exchange rate regime, together with opening critical sectors, such as logistics and telecoms, to private and foreign participation. In July 2024, the government adopted a market-based exchange rate regime, allowing the value of its currency, the Birr, to be determined by market forces. These reforms signal stronger alignment with global financial institutions and are designed to enhance investor confidence. Ethiopia continues to invest in trade infrastructure, such as the Ethiopia-Djibouti Standard Gauge Railway, the Addis Ababa-Adama Expressway, and major logistics and warehousing facilities, while deepening engagement with the African Continental Free Trade Area and COMESA enables access to broader markets

Early Milestones

Since 2019

Since establishing its Ethiopia office in 2019, TMA aligned its work with the Government’s Home-Grown Economic Reform Agenda and national logistics strategy, inorder to back the country’s agenda to reduce trade costs, modernise supply chains, and unlock regional market access. Notable milestones in the early years include supporting the operationalisation of the Moyale one stop border post with Kenya, which has slashed trans-shipment dwell times from four days in 2017 to 1.5 in 2021 (Time, Traffic, and User Satisfaction survey conducted post-implementation, 2021) and enhanced trust in border efficiency.

On the eastern flank, a completed feasibility study for a digital truck management system along the Berbera Corridor contributed to charting a path to seamless cross-border logistics with Somaliland. Meanwhile, the digital overhaul of the Ethiopian Chamber of Commerce replaced paper-based Certificates of Origin with a fully online system integrating with customs and improving speed and transparency for exporters. TMA’s programming helped prepare over 1,000 businesses and public sector actors to engage the AfCFTA, with tangible gains for women traders, over 200 now operate from a secure, serviced market at Moyale, with access to training and finance.

Enhancing the Trade and Investment Environment

Working with the Ministries of Trade and Finance, we are drafting a National Export Strategy, embedding technocrats to steer Ethiopia’s AfCFTA implementation and WTO accession, and convening evidence-based dialogues that align public and private incentives along the Djibouti, Berbera and LAPSSET corridors. Clear, predictable rules lower investor risk and keep reform momentum honest.

Improving Standards and Market Access

TMA is supporting select value chains to close the quality gap that keeps Ethiopian coffee, leather and horticultural exports parked in the lower value market segments. A strengthened standards policy, new inspection laboratories and tighter coordination among accreditation, testing and metrology agencies, are being paired with harmonised product standards across COMESA and the EAC. The result will be fewer non-tariff barriers at the border and a stronger quality signal for Ethiopian goods abroad.

Digital Trade

Systems

By supporting the roll out of an electronic cargo tracking system on the Berbera and Djibouti Corridors, developing an integrated border management system, and piloting blockchain-based traceability in select value chains, TMA is modernising trade systems. Together with a forthcoming e-commerce framework and a national trade information portal, these digital tools will convert paper-bound clearance into real-time auditable transactions, thereby cutting dwell times and improving Ethiopia’s supply chains.

Strengthening Physical Connectivity

Together with the Government, TMA is mobilising capital for one-stop border posts at Tog Wajaale and Galafi, a climate-smart inland container depot near Jigjiga, and for upgrades on the Ethio-Djibouti railway. Each project reduces freight costs, diversifies maritime access and builds resilience against shocks, whether geo-political or climatic.

Sustainable Trade and Financial Access

Growth that bypasses small traders is only half-won. By financing safe market facilities at Moyale and Tog Wajaale, expanding vocational training in logistics, deepening digital savings groups and advocating simplified trade regimes for women and youth, informal entrepreneurs will move from the margins to the mainstream.

TMA Strategy 3

2023 - 2030

Ethiopia’s pivot to an inclusive market-driven economy needs faster, cheaper and more predictable trade. TMA interventions will therefore concentrate on modernising rules, systems and corridors so that the land-locked nation of 123 million can compete on merit.

Interventions are structured around the following broad themes:

Green Trade

Digital Trade Systems

Resilient and Inclusive Trade

Value and Quality of Traded Goods

Physical Infrastructure

Trade and Investment Environment

- Enhancing the Trade and Investment Environment

Supporting the Ministries of Trade and Finance, to draft a National Export Strategy on one hand, while on the other embedding technocrats to steer Ethiopia’s AfCFTA implementation and WTO accession, and convening evidence-based dialogues that align public and private incentives along the Djibouti, Berbera and LAPSSET corridors. Clear, predictable rules lower investor risk and keep reform momentum. - Improving Standards and Market Access

Efforts are underway to strengthen select value chains by addressing the quality constraints that limit Ethiopia’s coffee, leather, and horticultural exports to lower-tier markets. A revitalised standards policy, the establishment of modern inspection laboratories complete with modern equioments, and enhanced coordination among accreditation, testing, and metrology institutions are central to this approach. These national efforts are being complemented by the harmonisation of product standards across COMESA and the EAC, thus reducing non-tariff barriers at the border and sending a stronger quality signal for Ethiopian goods in regional and international markets. - Digital Trade System

By supporting the roll out of an electronic cargo tracking system along the Berbera and Djibouti Corridors, developing an integrated border management system, and piloting blockchain-based traceability in select value chains, trade systems in Ethiopia are undergoing modernisation. These efforts, complemented by a forthcoming e-commerce framework and a national trade information portal are expected to transform paper based clearance processes into real-time auditable transactions, thereby cutting dwell times and improving reliability and efficiency of Ethiopia’s supply chains. - Strengthening Physical Connectivity

Together with the Government, TMA is mobilising capital for one-stop border posts at Tog Wajaale and Galafi, a climate-smart inland container depot near Jigjiga, and for upgrades on the Ethio-Djibouti railway. Each project reduces freight costs, diversifies maritime access and builds resilience against shocks, whether geo-political or climatic. - Sustainable Trade and Financial Access

Growth that bypasses small traders is only half-won. By financing safe market facilities at Moyale and Tog Wajaale, expanding vocational training in logistics, deepening digital savings groups and advocating simplified trade regimes for women and youth, informal entrepreneurs will move from the margins to the mainstream.

COUNTRY DIRECTOR, ETHIOPIA

Ewnetu has led TMA’s multi million-dollar investments in Ethiopia since 2020 and currently oversees major regional programmes including the EU-funded Corridor Development Programme that is targeting a 15% reduction in transit time and costs along the Djibouti–Ethiopia corridor, and delivering Ethiopia’s first digital SPS certification platform. His portfolio also includes initiatives in digital trade systems, fleet management, and knowledge institutionalisation within major trade agencies.

With over 20 years’ experience in Ethiopia’s transport and logistics sector, Ewnetu previously helped Ethiopia develop its import and export trade logistics systems along with inaugurating the new multi-modal transport system. He served as the founding General Manager of the Ethiopian Dry Port Services Enterprise, spearheading the development of Modjo Dry Port that cut cargo dwell time from 30 to 9 days. He holds an MBA in International Management from London South Bank University and a bachelor’s in business management from the University of Asmara.