Quick Stats

Cote d’ Ivoire

32 Million (2024)

$78 Billion (2024)

2024

Abidjan-Lagos

Gold (19%), Cocoa (17%) and Rubber (11%)

Data Source:

- Population and GDP size- World Bank Data – https://data.worldbank.org/indicator

- Trade- OEC- https://oec.world/en/profile/country/

Côte d’Ivoire is positioning itself as a trade and industrial powerhouse in West Africa and has recorded one of the fastest and most sustained economic growth rates in sub-saharan Africa over ten years. According to the World Bank, between 2012 and 2019 it maintained an average real GDP growth of 8.2%, and between 2021 and 2023 an average real GDP growth of 6.5%.

322,462 sq

kms

32 Million people

Under its National Development Plan (2021–2025), the Government has committed approximately $100 billion, largely private sector-led, to structural transformation, infrastructure upgrades, and job creation (World Bank, 2025). At the heart of this plan lies an ambition to shift from exporting raw commodities to value-added production, boost industrial clusters, and build a more inclusive economy that leaves no one behind. Budgetary and structural reforms have continued to strengthened investor confidence.

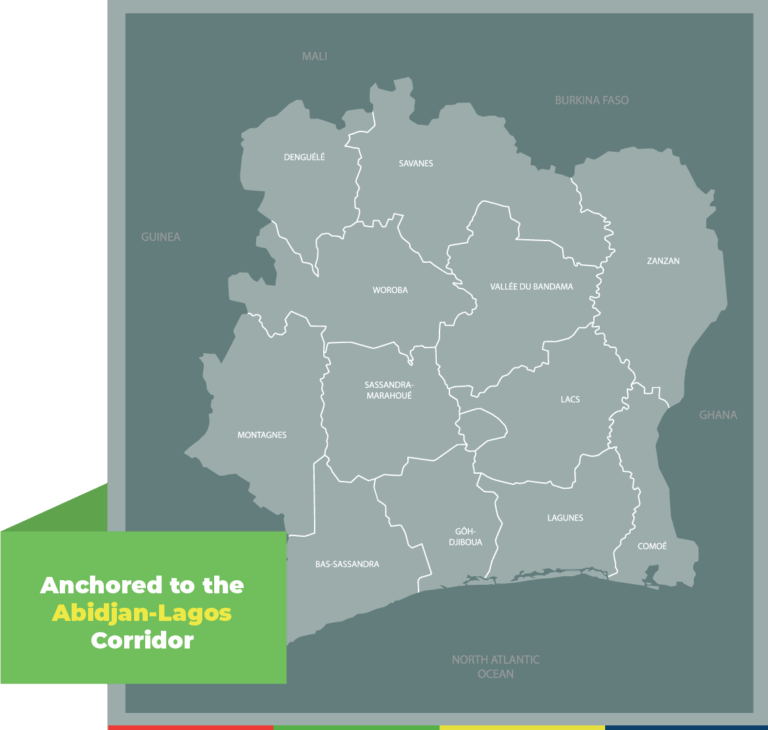

Anchored to the Abidjan-LagosCorridor

Côte d’Ivoire is a signatory to the African Continental Free Trade Area (AfCFTA) and an active member of the Economic Community of West African States (ECOWAS) and the West African Economic and Monetary Union (UEMOA). These platforms offer opportunities to diversify exports and deepen integration with neighbouring markets, such as Ghana, Burkina Faso, Mali, and Guinea. The country’s exports are dominated by cocoa, of which it is a world leader, cashew nuts, (exports of processed products reaching over 330,000 tons), cotton, and oil. Recent efforts have focused on processing capacity and market diversification.

Yet despite tariff liberalisation, businesses still face persistent non-tariff barriers, inconsistent regulatory requirements, and sluggish customs clearance, particularly along the Abidjan-Lagos Corridor, where over 60 checkpoints add costs and delays to regional trade.

Early Milestones

Since 2024

TMA is establishing its Côte d’Ivoire office under its West Africa Programme, to tackle physical and regulatory trade bottlenecks, with the aim of reducing trade costs, boosting private sector competitiveness for job creation, and accelerating regional economic integration

The programme operates across three mutually reinforcing levels: regional, corridor, and country specific interventions.

TMA Strategy 3

2023 - 2030

TMA is establishing its Côte d’Ivoire office under its West Africa Programme, to tackle physical and regulatory trade bottlenecks, with the aim of reducing trade costs, boosting private sector competitiveness for job creation, and accelerating regional economic integration. Strategic priorities include:

Physical Connectivity

Digital Trade Systems

Resilient and Inclusive Trade

Quality and value of traded goods

The programme operates across three mutually reinforcing levels: regional, corridor, and country specific interventions.

- At the regional level, the goal is regulatory coherence. TMA will support Ivorian authorities to align national policies with AfCFTA and ECOWAS commitments. Legal and technical assistance will harmonise customs procedures, update trade-related legislation, and strengthen sanitary and phytosanitary (SPS) systems, and standards agencies. This will extend to partnership with the government to modernise border systems – from electronic certification to interoperable single windows to reduce red tape.

- The second layer focuses on the trade and transport corridors. Alongside ECOWAS and its Project Preparation and Development Unit, support will be provided to translate corridor ambitions into bankable and viable infrastructure pipelines. In parallel, interventions that streamline inspections, reduce trans-shipment delays, and foster mutual recognition across border agencies will be designed.

- At the country level, Côte d’Ivoire’s competitiveness will be determined by how it supports sectors with export potential, such as cocoa, cashew nuts, fisheries, and cotton. The objective is to shift from commodity trade to market-ready, compliance-based production in line with the Government’s National Development Plan (2021–2025). Support will include upgrading SPS systems, expanding access to finance and certification, and offering business development services so that SMEs can move from raw commodities to compliant, market ready products.

FLAGSHIP REGIONAL INITIATIVES

Swedish Initiative for Facilitating Trade (SWIFT)

Cote d’Ivoire participates in this multi-country, and multi corridor, programme to modernise trade infrastructure along the Abidjan–Lagos Corridor. Activities include customs digitisation, inter-agency connectivity, and inclusive infrastructure.

Making Trade Work for Women (Global Affairs Canada)

Targeting 80,000 traders (70% women) in six West African countries: Burkina Faso, Ghana, Ivory Coast, Togo, Benin, and Nigeria, focusing on financial inclusion, climate resilience, and digital market access for women led enterprises.

COUNTRY DIRECTOR, Cote d’Ivore

Mrs Harriet Odembi Gayi leads TMA’s West Africa and AfCFTA portfolio, where she has been instrumental in setting up and steering the region’s programme since its inception in 2023.

Harriet brings to the role over three decades of experience in trade, agriculture, and economic development. Prior to joining TMA, she held senior leadership positions including Deputy Chief of Party for the USAID Feed the Future Staples Project in Tanzania and Director of Agriculture and Agribusiness at the USAID East Africa Trade and Investment Hub. Her earlier career includes key roles within the UN.

Harriet blends private sector know-how with deep policy insight. Her work spans formal and informal trade systems, logistics, and regional integration, with a particular focus on women’s economic empowerment and inclusive growth. She now leads the delivery of high-impact solutions to some of West Africa’s most complex cross-border trade challenges, anchoring her work within the ambitions of the AfCFTA.