Tanzania has one of the biggest agricultural sectors in Africa, with multiple commodities produced and exported to multiple markets in the world. Dominant agricultural commodities marked for export include cashew nuts, tobacco, cotton, cocoa, tea, and sesame. These commodities have recorded significant increase in exports over years. However, gains to farmers and communities engaged in production have remained limited, with income distribution of the proceeds skewed to middlemen. Middlemen often purchase these commodities from farmers at cheaper prices (gate price), only to re-sell with large margins, leaving farmers with minimal incomes to sustain their livelihoods.

TradeMark Africa (TMA)’s support to Tanzania’s Mercantile Exchange (TMX) started in 2019, to ensure that farmers can access reasonable prices for specified commodities, based on principles of fair competition, transparency, and quality of their produces. Funded by United Kingdom’s Agency for International Development, Ireland and Norway through TMA, the project support aimed to automate the TMX system, to allow for online trading of key agricultural crops, which has also been accompanied by training sessions to more than 15,000 stakeholders, including farmers (sellers), cooperative unions, buyers, aggregators, officers, and industrial professionals on ways and benefits of online commodity trading. With TMA’s support, value chains analysis for sesame, green gram, lentils, cashew nut, cocoa, and livestock have been conducted.

Currently, cashew nuts, sesame, cocoa, lentils, and green grams are being traded through the commodity exchange system, which has led to increased incomes for farmers (in certain instances, more than double the price), increased revenues for the Government and improved means of handling payments.

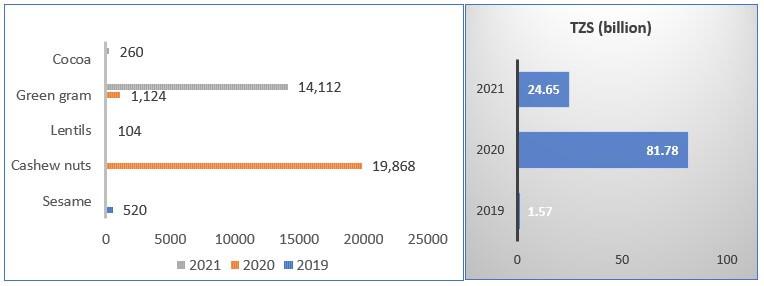

A total of 56,367.5 MT of commodities have been traded through the TMX system between 2019 and 2021, at a value of TZS 108 billion (as shown below). About 95% of the total value of the commodities has been paid to farmers to a tune of TZS 103 billion, significantly higher than what the farmers earned in previous seasons by 1,500 TZS per kilogram. High volumes and values in 2020 resulted from trading of cashew nuts, which was later suspended in 2021. The commodity will be back online during the 2022 trading season.

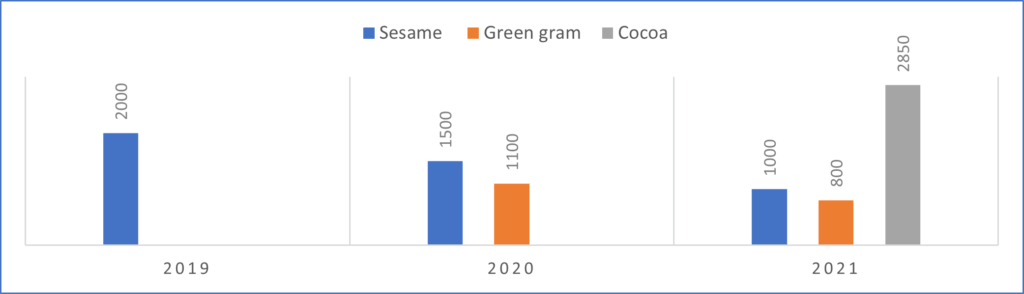

Trading through the TMX system has not only significantly improved farmer livelihoods through increased incomes as a result of fetching fairer prices but also ensure availability of market information. The bar graph below presents a breakdown of additional earnings accrued to farmers per kilogram for each traded commodity per season, revealing the difference between prices outside the system versus prices observed through the system

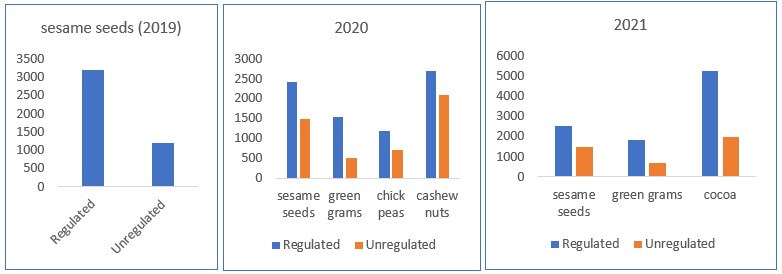

In most of the traded products, prices have more-than-doubled when traded through the system, compared to when traded through unregulated channels. In 2020, the recorded price for green grams, once traded through the system, was 3-times the price traded through other channels. Prices for sesame seeds and cocoa doubled between 2019 and 2021, while for cashew nuts and chickpeas prices increased by 1.3 and 1.7 times respectively. On average, over the three years, prices increased two-fold for all products traded through the system.

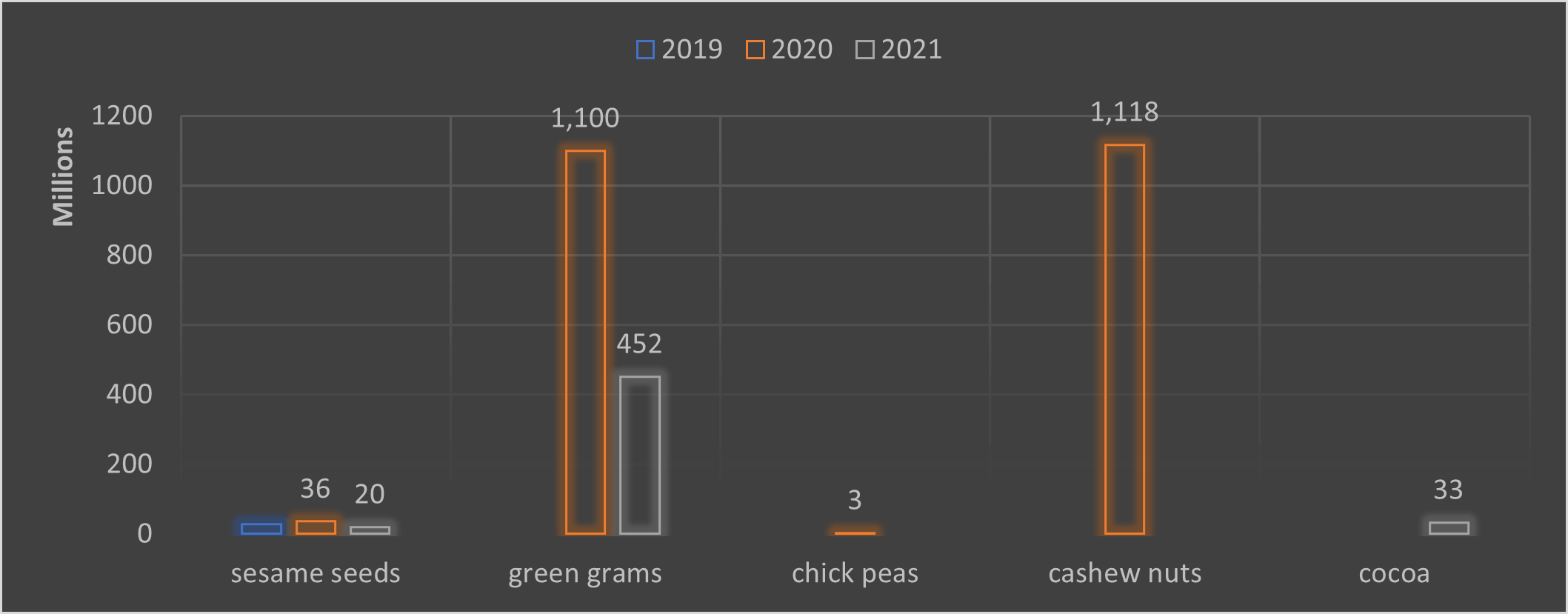

Trading through the system has increased and eased revenue collection by government through the respective authorities and boards. Data shows that high trading seasons through the system translated to high revenue collection, increasing with respect to volumes traded.

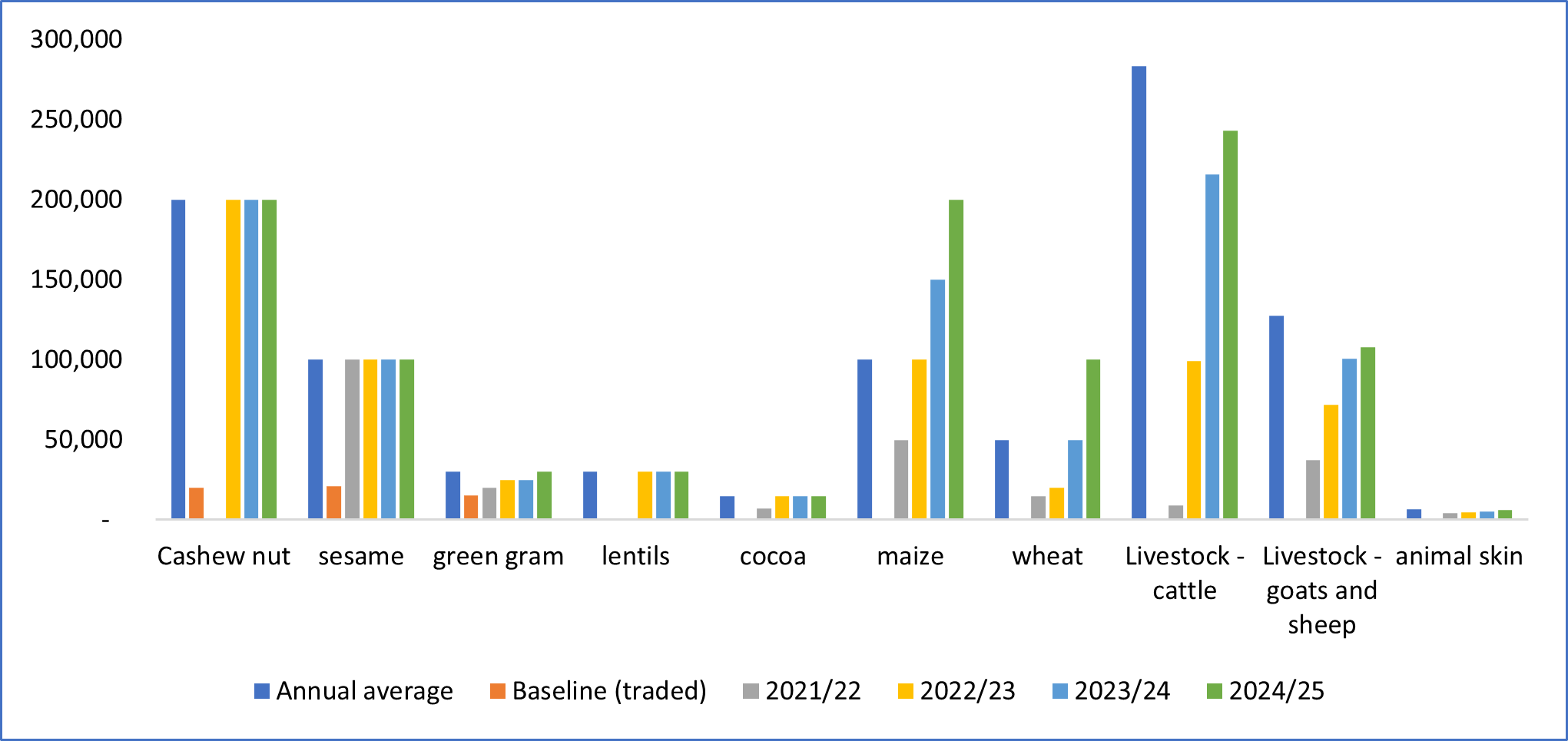

Other crops being piloted for inclusion onto the system include livestock (live animals) and animal products, horticulture products, cotton, and grains. The figure below highlights projections for each commodity on the system in the coming years (in Tonnes); with maize, cashew nut, and livestock showing strong potential.

Key: Annual average shows the total production amounts (tradeable amounts on average), while baseline shows the amounts already traded through the system, and each FY shows the projected volumes to be traded in the future for each commodity.

Through TMA’s support, Electronic Display Units will be supplied and installed at 4 strategic locations of Dar es Salaam, Mwanza, Arusha, and Morogoro for Market Information Dissemination.

What More Can Be Done?

Making the System Sustainable

TMA in partnership with TMX continues to engage the Government and its relevant agencies and authorities to ensure that pending issues are addressed and resolved by undertaking some initiatives to include: