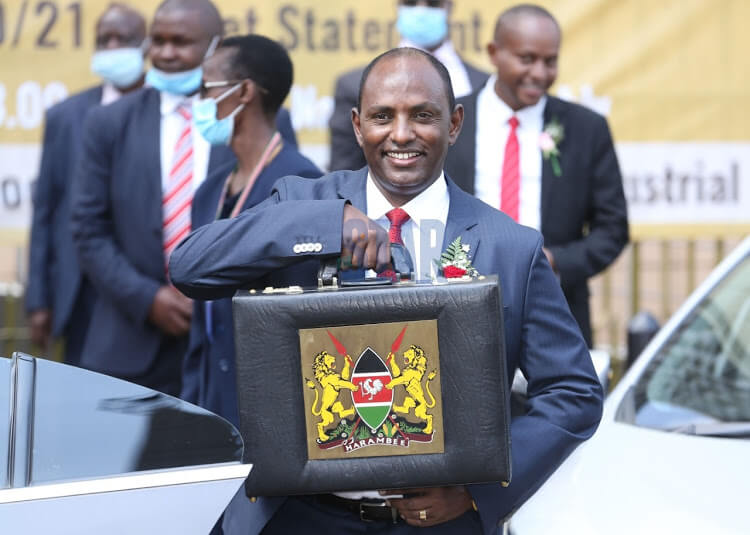

This includes the Economic Stimulus Programme and the Credit Guarantee Scheme announced by National Treasury CS Ukur Yatani last Thursday.

Yatani has availed Sh225.7 billion including Sh172 billion in forgone taxes and Sh53.7 billion direct funding to cushion sectors of the economy.

This translates to about two per cent of GDP, which experts feel is half what the country needs.

Economic and tax experts at the audit firm say although the government has responded by providing support both in foregone taxes as well as direct liquidity injection, more needs to be done to revive the economy.

They recommend at least Sh393.7billion or four per cent of GDP if the interventions are to make an impact on the economy’s revival, saying more needs to be done.

“At least four per cent of GDP is required to jumpstart a battered economy like ours. On the basis of this, the government intervention falls short by about Sh170 billion,” Christopher Kirathe, a tax partner at the audit firm said.

In addition to implementing the Economic Stimulus Programme, the government is formulating a Post-Covid-19 Economic Recovery Strategy to mitigate the adverse impacts on the economy, and further re-position the economy on a steady and sustainable growth trajectory.

CS Yatani has set aside Sh3 billion seed capital to operationalize the proposed Credit Guarantee Scheme, aimed at providing affordable credit .

The government is engaging a number of development agencies to boost the kitty.

To further support and enhance the liquidity of enterprises, the CS proposed to fast track payment of outstanding verified VAT refund claims and pending bills owed to businesses by allocating Sh10billion.

This is in addition to the Sh23.1 billion approved in a supplementary budget by Parliament in April.

“I further propose an allocation of Sh712 million to provide credit targeted to Micro, Small and Medium Enterprises in the manufacturing sector,” Yatani announced.

Experts at the audit firm however fear that while the intentions might be noble, treasury will not meet the threshold needed to grow all the key sectors that have been battered by Covid-19 among other challenges.

According to the firm, health, freedom of movement, food security, employment, education, trade, and leisure are severely affected.

“There is hardly any aspect of our social and economic system that has not been shackled or halted by the present crisis,”Kirathe said.

While presenting his proposals contained in the 2020/2021 budget, Yatani authorized the Kenya Revenue Authority to increase excise duty chargeable on at least 31 goods by about 5.5 per cent, setting the stage for higher retail prices effective July.

Kirathe said the tax measures are weak and might not be sufficient to jump-start economic upturn.

The audit firm has also termed the country’s revenue stream as volatile amid high spending.

Kenya’s primary tax revenue streams are from a range of income, property and consumption taxes.

The combined weakening economy resulting from closure of businesses, laying off of employees, locked down global supply chains, will put pressure on government’s projected revenue of Sh1.62 trillion set for KRA.

The country is further expected to under pressure from IMF to reverse some of its tax measures, further creating uncertainty for businesses.

Spending on public health measures to prevent the spread of the virus,as well as equally higher spending on unemployment, social protection and social welfare are expected to dent the coffers.

“The above matters, combined, project a period of higher spending and lower tax revenue, which has the potential to undermine Kenya’s fiscal balance and Kenya may suffer from a phenomenon known as “scissors effect”, Kirathe said.

Unless faced with bolder fiscal and monetary policies, this effect if sustained would result in a crisis and claw back of the interventions provided, the firm notes.

Source: The Star