Our Projects are

Transforming African Trade

Quick Contacts

2nd Floor, Fidelity Insurance Centre Waiyaki Way, Westlands

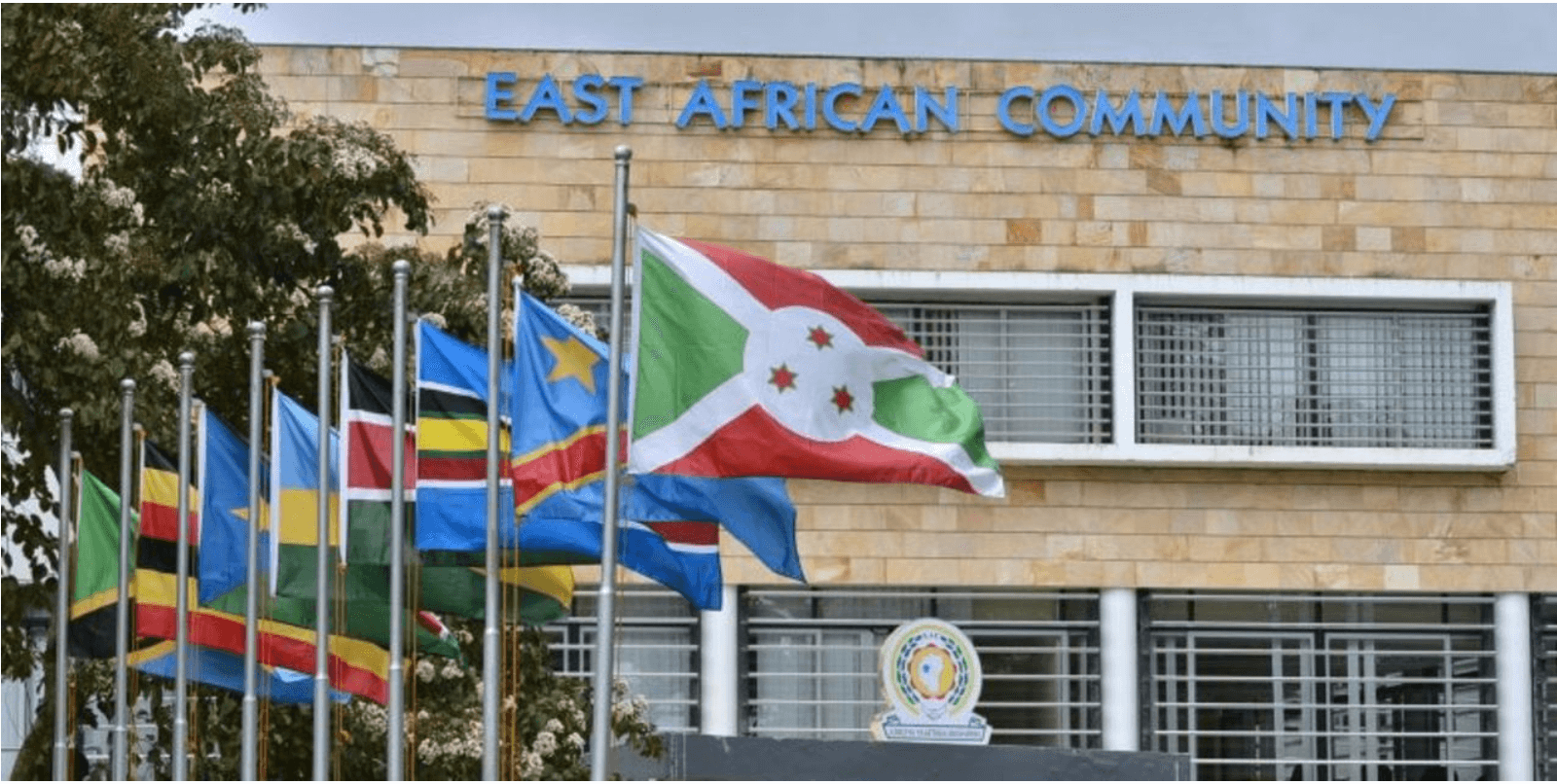

Dar es Salaam. The East African Community (EAC) member states have been challenged to embrace technology to facilitate cross-border payments within the regional common market. The regional body says technological innovation in the area would enable cross-border traders and investors to pay and receive payments for goods and services through a cost-effective payment system, therefore increasing intra-regional systems, trade, and investment. EAC made the call during the recent two-day roundtable discussion on the coordination of EAC donor support in the payment systems, which took place at the EAC Headquarters in Arusha, Tanzania. The forum has brought together development partners, partner states, central banks and the EAC secretariat experts on payments and settlement systems.

In her speech, the EAC secretary general, Ms Veronica Nduva, said central banks in partner states should embrace technological changes to facilitate cross-border payments in the region. She underscored challenges facing the region, including the low uptake of the East African Payments System (EAPS) due to limited capacity, lack of interoperability, communication gaps between central banks and stakeholders, fear of online scams, protectionism by central banks, and overlapping membership by partner states to payment systems set up by different regional economic communities. She said that launched in 2014, the EAPS is a secure, effective, and efficient funds transfer system aimed to enhance the efficiency and safety of payments and settlements within the region. “Central banks are responsible for putting in place an efficient payments and settlements system for the region. Unlike many markets in goods and services, financial markets and systems are trust-based markets,” she said, challenging central banks to build public confidence in the new technology-driven payment systems. According to the EAC statement signed by the senior public relations officer of the corporate communications and public affairs department, Mr Simon Owaka, the regional boss, facilitating cross-border traders and investors to pay and receive payments for goods and services through a cost-effective payment system will increase intra-regional systems, trade, and investment.

She said an efficient and reliable cross-border payment service was essential for the smooth functioning of any regional economic integration, including the EAC. “It is partly for this reason that the East African Monetary Union (EAMU) Protocol requires member states to harmonise and integrate their payment and settlement systems during the transition to a single currency to promote trade and investment in the region,” she said.

Over the last decade, with support from development partners, different initiatives have been implemented at the national and regional levels towards modernisation and integration of payment systems in the region,” she added. However, she said some initiatives were implemented by the public sector, through central banks, while others were executed by the private sector, via commercial banks, mobile money operators, and several other stakeholders. She said the new technology adoption has transformed the payment systems landscape to far-reaching, hinting that digital financial services have made payment systems efficient, less expensive, and more inclusive in most member states. “Currently, at national levels, there exist infrastructure and governance structures that allow the private sector to better provide payment and financial services,” said Ms Nduva. Commercial banks, she said, have traditionally specialised in bulk transfers that process high-volume and wire transactions that often involve high values.

Furthermore, she said mobile money operators have focused on retail payments and have been vital in improving financial inclusion among millions of poor and unbanked people, noting that much progress has been at domestic transactions. “The progress on cross-border payments has been much slower, making it slow and expensive to move money from one partner state to another,” she said, hinting that interoperability of digital payment systems at the regional level was missing. She encouraged an increase in the EAPS uptake to prevent banks in the region from relying on foreign correspondent banks to effect regional cross-border payments. Ms Nduva said partner states should build on successes at the domestic level to attain interoperability of digital payment systems at the regional level.

“Our aspiration as a region is to make cross-border payments faster, safer, cheaper, transparent, and more integrated to facilitate trade and financial inclusion in the region,” she said. “This is possible through the harmonisation of policies and regulations; enhancement of payment systems infrastructure; and capacity building of payment system actors and stakeholders,” she said. The Bill and Melinda Gates Foundation senior programs officer for East Africa, Ms Amani M’Bale, said payment systems enhance financial inclusion for all groups, noting that they were key to addressing poverty and household resilience in the region.

“Cross-border payment systems are crucial for intra-regional trade. The Bill and Melinda Gates Foundation will support such systems at the national and regional levels,” she promised. Trademark Africa (TMA) chief of programs and deputy chief executive officer, Ms Allen Assiimwe, said cross-border traders lose large sums of money due to currency exchanges during payments. She disclosed that financial transactions were another pillar that TMA was working on due to the informal nature of trade at the regional and continental levels. “More than 70 percent of our trade is informal, so we need to get our payment systems right,” she said. The director for regional integration coordination at the African Development Bank (AfDB), Dr Joy Maria Kategekwa, said the multilateral lender was interested in building capacity in regional payment systems on top of ensuring their interoperability and functionality. She commended the Pan-African Payment System (PAPSS) for easing cross-border payments and transactions across the African continent. PAPSS is a financial market infrastructure that enables instant, cross-border payments in local currencies within African markets. “It is designed to revolutionise cross-border payments, making them faster, cheaper, and safer.”

Read original article

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TradeMark Africa.