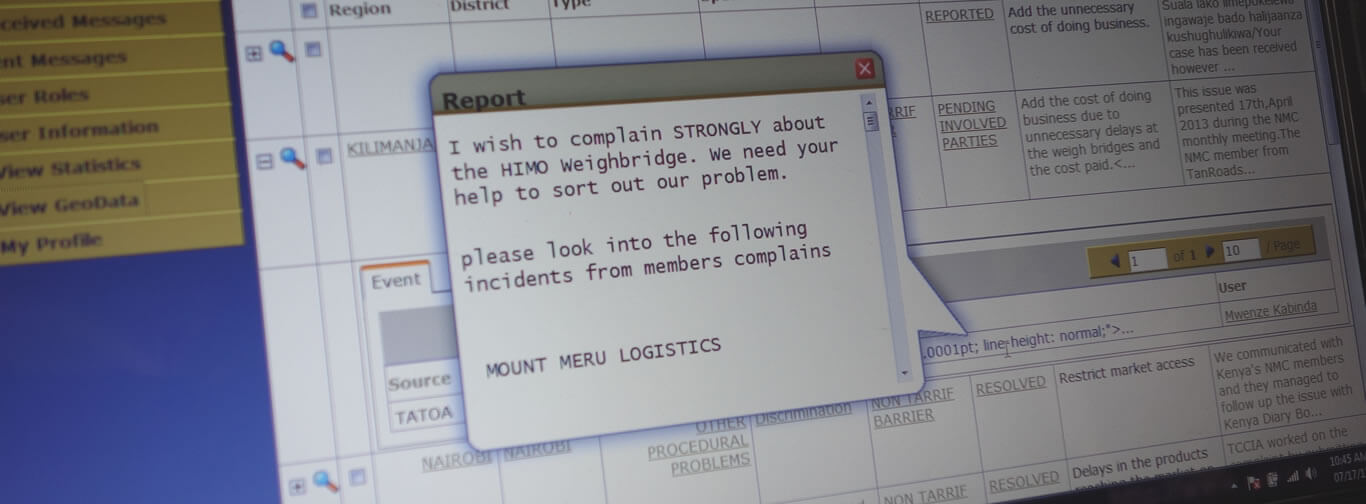

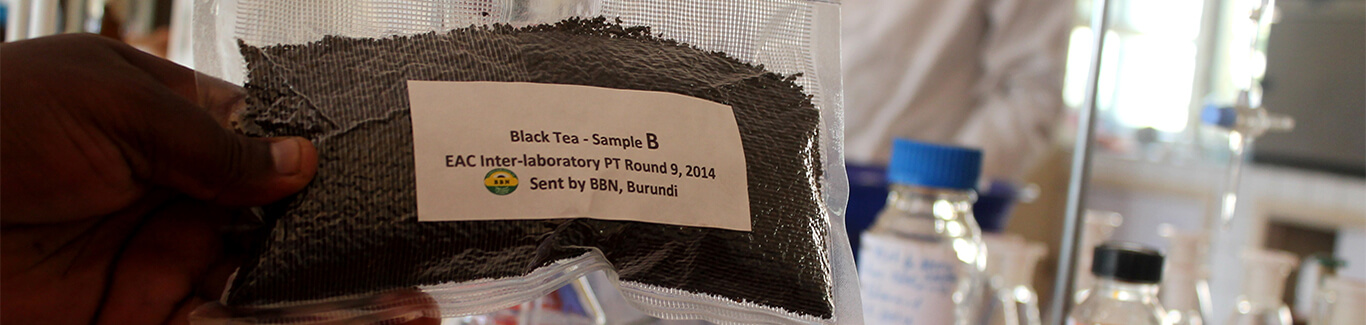

[vc_row][vc_column][custom_inner_menus select_menu="project"][/vc_column][/vc_row][vc_row][vc_column][single_project_block_1 heading="Tanzania NTB National Monitoring Committee" implementor="Tanzania NTB National Monitoring Committee" target_group="Public and Private Sector group" project_value="US$ 1,374,014.45" implementation_period="2011 - 2017" download_btn_text="Download Project PDF" download_btn_link="#url"]NTBs account for a significant proportion of the high transportation costs in the EAC which are estimated to limit intra-regional trade by approximately 15% [World Bank] and constitute significant limitations to foreign direct investment. The existing NTBs have also created a mechanism which funds government institutions and a culture which also includes the possibility of corruption. In Tanzania, foreign-registered cargo trucks are required to pay US$ 500 to the Tanzania Revenue Authority (TRA) on each entry, in addition to annual fees of $600. This makes eliminating NTBs one of the highest priorities for the EAC Secretariat and member states. What: Elimination of NTBs. Key outputs include; Chamber programme on advocacy and monitoring of NTBs designed and delivered Awareness, training, stakeholder consultation and study tours on NTB removal conducted How: Advocating and dialogue through the National Monitoring Committee (NMC) Contact: Elibariki Shammy, Email: [email protected] Click here to learn more about One Stop Border Posts Program[/single_project_block_1][/vc_column][/vc_row][vc_row el_id="desired-result"][vc_column][single_project_block_2 heading="Desired Results" image_1="42718" image_2="42678"]Elimination of Non-Tariff Barriers (NTBs) which will contribute to reduction in transport costs along key corridors in East Africa[/single_project_block_2][/vc_column][/vc_row][vc_row disable_element="yes"][vc_column][project_single_ele_3_container heading="More Project Insights." sub_heading="Projects Highlights From A Glance" slide_1="info access for 20 crops & over five breeds of livestock" slide_2="info access for 20 crops & over five breeds of livestock" slide_3="info access for 20 crops & over five breeds of livestock"][single_project_content]Key output includes: Consolidating the results of...

Tanzania NTB National Monitoring Committee

Posted on: September 25, 2014

Posted on: September 25, 2014