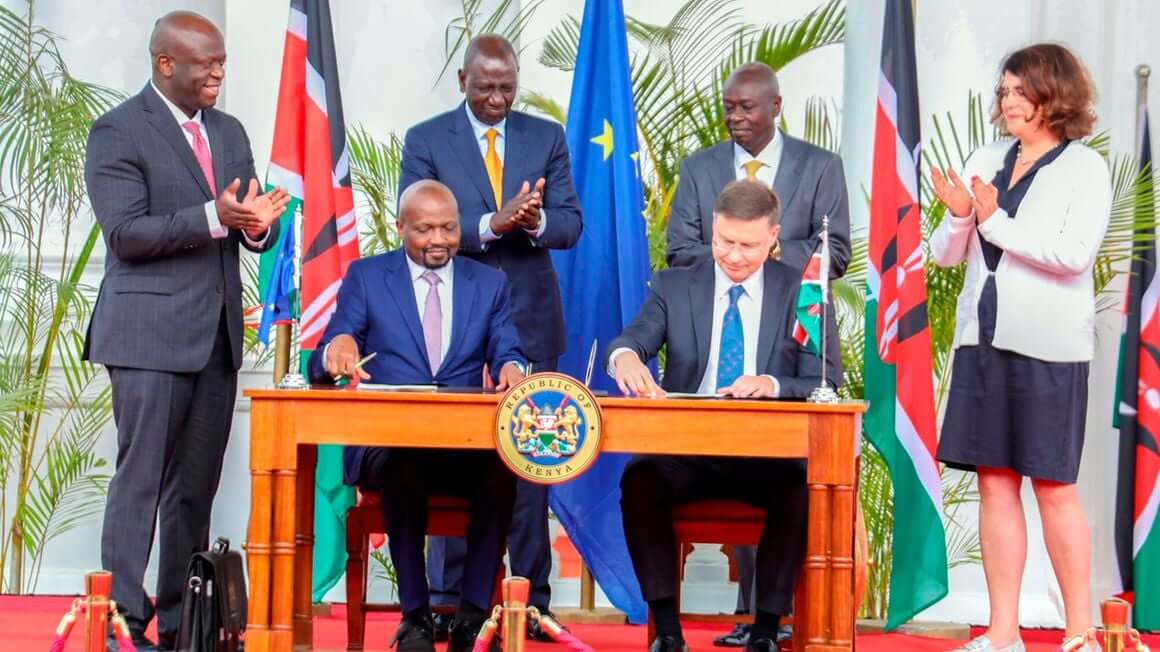

The Uganda National Bureau of Standards (UNBS) together with the South Sudan National Bureau of Standards (SSNBS) are set to harmonise sampling, test methods, and certification processes to enhance bilateral trade between the two countries. The resolution is one of the many reached during a meeting between the two National Standards Bodies held in Nimule. The engagement, which was led by both the UNBS Ag. Executive Director Daniel Richard Nangalama Makayi and the SSNBS Chairperson and Chief Executive Officer (CEO) Dr. Kuorwel Kuai Kuorwel, came after a recent standoff between Uganda and South Sudan over maize exports from Uganda, which saw a joint Ugandan delegation travel to Elegu-Nimule in 2023 to negotiate the release of impounded Ugandan trucks with maize grain and flour in South Sudan. Since then, UNBS embarked on batch sampling and laboratory analysis of maize grain and flour exports to South Sudan in designated sampling yards in Central (Afrokai in Matugga), Eastern (Uhuru Parking, Mbale), and Northern Uganda (Layibi in Gulu), utilizing the UNBS Central and regional testing laboratories. Since this intervention, 346 out of the 367 samples representing 94.2% of the total maize flour samples analyzed, complied with the standard requirements and were from 23 companies certified by UNBS. The two National Standards Bodies have thus agreed that; All products covered by Compulsory Standards including cereals and cereal products (mainly maize flour) must be certified by UNBS before being exported to South Sudan from Uganda. A Sanitary and Phyto-Sanitary (SPS) certificate from competent authorities in Uganda MUST accompany other products exported...

Uganda, S. Sudan Standards Agencies Move to Enhance Cross Border Trade

Posted on: January 19, 2024

Posted on: January 19, 2024