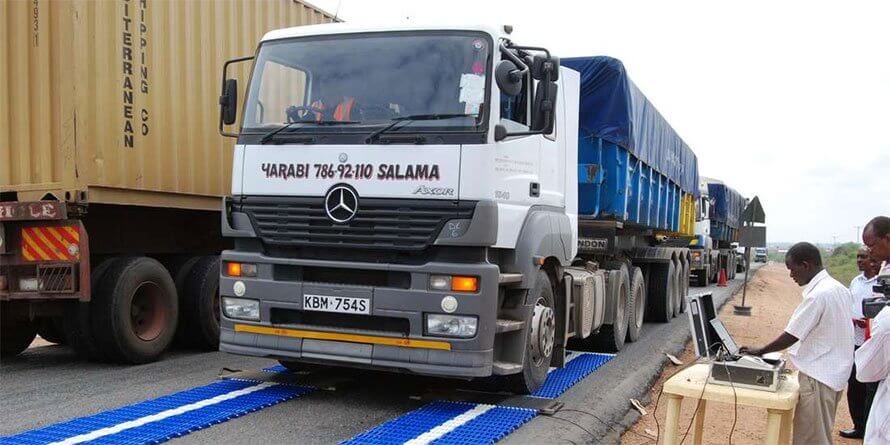

The Kenyan government says all transit cargo will be moved by the Standard Gauge Railway from Mombasa to Naivasha where truckers will pick them for delivery to Uganda, Rwanda, and South Sudan. Truck drivers have been seen as a weak link to spreading coronavirus and partner countries are trying to devise means to reduce their contact with the community. Early this month, the East African Heads of States directed the ministers responsible for Health, Transport, and EAC Affairs to adopt a Digital Surveillance and Tracking System for drivers and to immediately develop a regional mechanism for monitoring truck drivers to reduce the impact of the Covid-19 pandemic. The move is meant to reduce contact of drivers with local people, the main cause for the spread of coronavirus disease. Some of the cargo will move on the old meter-gauge railway directly to Tororo in eastern Uganda or Kampala, while fuel will be transported by pipeline to Kisumu, Kenya, and thereafter by water on Lake Victoria to Portbell in Luzira, Kampala or Jinja. This, according to the Kenyan minister in charge of transport, takes effect on June 1, 2020. James Macharia says the shift will cut off 600 kilometers that truck drivers would have to drive if they were to pick the goods directly from Mombasa port. Macharia said in a statement on Friday that Revenue authorities from Uganda, South Sudan, Rwanda, and Kenya will be accommodated at Naivasha inland deport to clear goods on time. Exports will also, be required to...