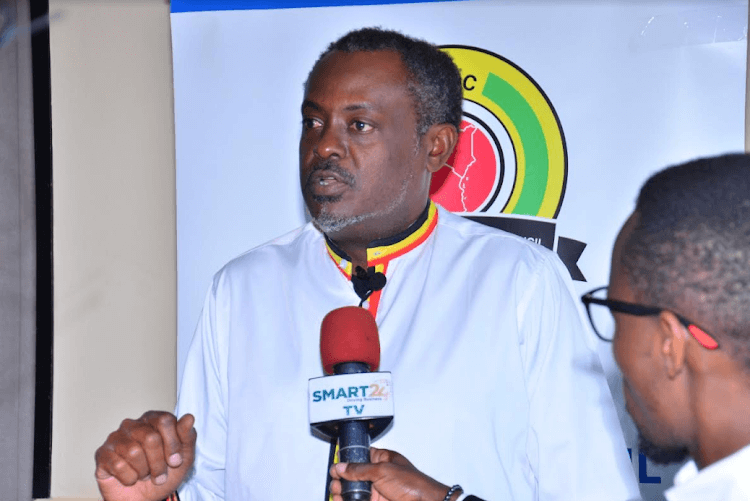

NAIROBI, Kenya (AP) — The first African Climate Summit opened Monday with heads of state and others asserting a stronger voice on a worldwide issue that affects their continent the most even though its 1.3 billion people contribute to global warming the least. Kenyan President William Ruto’s government and the African Union launched a ministerial session as more than a dozen heads of state began to arrive, determined to wield more global influence and bring in far more financing and support. The first speakers included young people, who demanded a bigger voice in the process. “For a very long time we have looked at this as a problem. There are immense opportunities as well,” Ruto said of the climate crisis, speaking of multibillion-dollar economic possibilities, new financial structures, Africa’s huge mineral wealth and the ideal of shared prosperity. “We are not here to catalog grievances,” he said. And yet there is some frustration on the continent about being asked to develop in cleaner ways than the world’s richest countries — which have long produced most of the emissions that endanger climate — and to do it while much of the support that has been pledged hasn’t appeared. “This is our time,” Mithika Mwenda of the Pan African Climate Justice Alliance told the gathering, claiming that the annual flow of climate assistance to the continent is a tenth or less of what is needed and a “fraction” of the budget of some polluting companies. “We need to immediately see the delivery of the $100 billion” of climate finance...

The first Africa Climate Summit opens as hard-hit continent of 1.3B demands more say and financing

Posted on: September 8, 2023

Posted on: September 8, 2023